Analysis of Factors Affecting Trust on the Use of FinTech (P2P Lending) in Indonesia

DOI:

https://doi.org/10.32736/sisfokom.v10i1.1068Keywords:

Structural Assurance, Integrity, Easy of use, Brand Image, FinTechAbstract

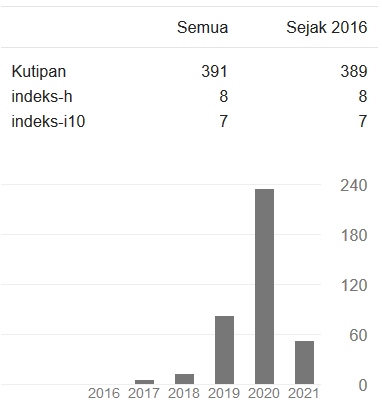

Since 2016 the P2P Lending industry has begun to develop in Indonesia. Peer to Peer Lending (P2P Lending) is a new alternative to getting funds in the form of money loans to individuals or investors. Fintech P2P Lending provides convenience through a simple and fast service. Its features can be accessed by anyone, anytime, anywhere. On the other hand, investors or lenders have investment alternatives with attractive returns. So that it quickly spread to all segments of Indonesian society. The purpose of this research is to analyze what factors can influence trust in using of P2P Lending in Indonesia. The difference between this study and previous research is that there is no research that focuses on trust in the use of FinTech, especially P2P Lending in Indonesia. This research is a type of quantitative research that used is primary data obtained by distributing questionnaires directly to Indonesians. The samples taken by Simple Random Sampling Technique and obtained 400 respondents as user fintech. And the statistical analysis used in this study is multiple regression and using SPSS 23 program. Based on the result, this study showed that the variable of structural assurance, easy of use, and brand image were significant on trust in using FinTech, meanwhile the variable of integrity was not significant on trust in using FinTech.References

P. Gomber, J. A. Koch, and M. Siering, “Digital Finance and FinTech: current research and future research directions,” J. Bus. Econ., vol. 87, no. 5, pp. 537–580, 2017, doi: 10.1007/s11573-017-0852-x.

PBI, “Peraturan Bank Indonesia tentang Penyelenggaraan Teknologi Finansial. PBI No.19/12/PBI/2017,” Gubernur Bank Indones., 2017.

M. G. Sitompul, “Urgensi Legalitas Financial Technology (Fintech): Peer To Peer (P2P) Lending Di Indonesia,” J. Yuridis Unaja, vol. 1, no. 2, pp. 68–79, 2019, doi: 10.35141/jyu.v1i2.428.

Otoritas Jasa Keuangan, “Perusahaan Fintech Terdaftar/Berizin (Peraturan OJK No . 77 Tahun 2016),” pp. 1–11, 2019.

Otoritas Jasa Keuangan, “Sp 10/xii/swi/2019,” 2019.

M. Van Deventer, “Antecedents of Trust in Mobile Banking Amongst Generation Y Students in South Africa,” Acta Univ. Danubius. Œconomica, vol. 15, no. 3, pp. 123–141, 2019.

Y. Jing and S. Cai, “Research on Influencing Factors of Consumer Trust in B2C E-commerce,” Proc. 2019 Int. Conf. Contemp. Educ. Soc. Dev. (ICCESD 2019), vol. 332, no. Iccesd, pp. 184–186, 2019, doi: 10.2991/iccesd-19.2019.45.

M. D. A. Saputra and W. Widiartanto, “Pengaruh Structural Assurance dan Perceived Reputation Terhadap Purchase Intention Melalui Trust Pada Konsumen Tokopedia,” J. Adm. Bisnis, vol. 8, no. 2, p. 111, 2019, doi: 10.14710/jab.v8i2.25925.

Y. P. Sijabat, D. M. Hutajulu, and P. Sihombing, “Determinasi Technology Acceptance Model Terhadap Niat Penggunaan Fintech Sebagai Alat Pembayaran ( Payment ),” Pros. Semin. Nas. dan Call Pap., vol. 1, no. 9, pp. 151–166, 2019.

M. R. Kabir, “Factors Influencing the Usage of Mobile Banking : Incident from a Developing Country Kabir,” World Rev. Bus. Res., vol. 3, no. 3, pp. 96–114, 2013.

I. P. Y. Semadi and M. Ariyanti, “The Influence Of Brand Experience, Brand Image, Andbrand Trust On Brand Loyalty Of Abc-Cash,” Asian J. Manag. Sci. Educ., vol. 7, no. 3, pp. 12–23, 2018.

M. Linda, N. Marlina, B. Purba, P. S. Akuntansi, and U. P. Batam, “Faktor-Faktor Yang Mempengaruhi Tingkat Kepercayaan Masyarakat Terhadap Penggunaan Teknologi Finansial Di Kota Batam,” J. EMBA J. Ris. Ekon. Manajemen, Bisnis dan Akunt., vol. 8, no. 1, pp. 922–934, 2020, doi: 10.35794/emba.v8i1.28042.

D. Harrison McKnight, V. Choudhury, and C. Kacmar, “The impact of initial consumer trust on intentions to transact with a web site: A trust building model,” J. Strateg. Inf. Syst., vol. 11, no. 3–4, pp. 297–323, 2002, doi: 10.1016/S0963-8687(02)00020-3.

R. E. Hair Jr, J. F., Black, W. C., Babin, B. J., & Anderson, Multivariate Data Analysis, 7th ed. Upper Saddle River: Pearson Prentice Hall, 2010.

I. Ghozali, Aplikasi Analisis Multivariate dengan Program IBM SPSS. Semarang: Universitas Diponegoro, 2012.

Downloads

Published

Issue

Section

License

The copyright of the article that accepted for publication shall be assigned to Jurnal Sisfokom (Sistem Informasi dan Komputer) and LPPM ISB Atma Luhur as the publisher of the journal. Copyright includes the right to reproduce and deliver the article in all form and media, including reprints, photographs, microfilms, and any other similar reproductions, as well as translations.

Jurnal Sisfokom (Sistem Informasi dan Komputer), LPPM ISB Atma Luhur, and the Editors make every effort to ensure that no wrong or misleading data, opinions or statements be published in the journal. In any way, the contents of the articles and advertisements published in Jurnal Sisfokom (Sistem Informasi dan Komputer) are the sole and exclusive responsibility of their respective authors.

Jurnal Sisfokom (Sistem Informasi dan Komputer) has full publishing rights to the published articles. Authors are allowed to distribute articles that have been published by sharing the link or DOI of the article. Authors are allowed to use their articles for legal purposes deemed necessary without the written permission of the journal with the initial publication notification from the Jurnal Sisfokom (Sistem Informasi dan Komputer).

The Copyright Transfer Form can be downloaded [Copyright Transfer Form Jurnal Sisfokom (Sistem Informasi dan Komputer).

This agreement is to be signed by at least one of the authors who have obtained the assent of the co-author(s). After submission of this agreement signed by the corresponding author, changes of authorship or in the order of the authors listed will not be accepted. The copyright form should be signed originally, and send it to the Editorial in the form of scanned document to sisfokom@atmaluhur.ac.id.